Issue #1: Launching Curated Curiosity

Wealth creation vehicles, consumer businesses, SMBs, indie makers, conglomerates, and making friends & trade partners

I am rebranding this substack to “Curated Curiosity” - space where I curate most insightful learning and contents according to my taste every week. At least 15-20 friends have said they like what I share online (mostly Instagram stories that disappear in 24 hours). It’s painful to retrieve those insights when I need them so I’ll just formalize them to a more enduring newsletter. I’m going to share beyond what I learn in Harvard.

Table of content

Curations of the week:

Choosing the right wealth creation vehicle is important - why $80 Mn is probably the ceiling in professional services jobs

Consumer / DTC businesses are more predictable asset class vs other venture bets

Maybe it’s possible to start high operating leverage business as an “indie maker”

Small medium businesses (SMB) has scale ceiling - managerial capacity

Building a tax-efficient conglomerate in the US

Why nations should make friends (and trade partners)

Curiosities of the week:

Hot takes

Open questions

Books / papers

Graphs / charts / tables / maps

Reach out to me if you have interesting topics to discuss / have interesting references

Curations of the week

Choosing the right wealth creation vehicle is important

Rajat Gupta was the Global Managing Director of McKinsey. He was caught due to involvement in insider trading. We discussed this in one of our LCA class (this is one of those “How not to go to jail” courses in HBS). I think he is insanely talented:

From an early age Gupta was identified as having extraordinary promise. He was admitted to one of the leading high schools in New Delhi (the Modern School) and ranked 15th in the country in the entrance examination for the highly competitive Indian Institutes of Technology (IIT). When he was 16, his father passed away. Soon after, his mother was diagnosed with heart disease and died two years later. Gupta was thrust into adulthood with significant responsibilities at an early age.

Upon graduating from IIT, Gupta was offered a job at the prestigious Indian Tobacco Company Limited (later ITC Limited). However, like many young Indians at that time Gupta wanted to go to the United States and thought school offered a promising avenue to do so. He applied and was admitted to Harvard Business School (HBS). He turned down the India Tobacco Company offer, and in the fall of 1971 set off for Boston.

Gupta was one of the youngest student of his HBS class, and only one of three from India. Despite his lack of experience, Gupta thrived at HBS. Carberry marveled: “Rajat constantly just floated above all this [hard work]. We all got the impression that the academic challenges at HBS were not that much of a challenge for him.

His estimated net worth was $80 Mn.

Gupta appreciated that his personal goals were evolving over time and these could present challenges. In response to a student who wanted to hear his attitude toward wealth creation during a visit to Columbia University after stepping down from McKinsey, Gupta offered his frank assessment: “I am probably more materialistic today than I was before and I think money is very seductive. … You have to watch out for it because the more you have it, you get used to comforts, and you get used to, you know, big houses and vacation homes, and going and doing whatever you want, and so it is very seductive. However much you say that you will not fall into the trap of it, you do fall into the trap of it.

That was an insane answer in a public setting (the question probably was coming from random MBA student in an event).

What’s my interpretation? I think $80 Mn in net worth is the ceiling for professional service jobs like consulting. Given Gupta’s level of talent and hunger, it’s not a great feeling when you see your less intelligent friends / clients making billions and you are merely collecting “spare changes”. The return to talent for Rajat Gupta is good but not spectacular.

On the other hand, I heard that there’s a $70 Mn buyout of a cake shop in Indonesia by a private equity firm. That’s a “boring” stable cash-flow business. I guess you can get similar if not greater return from less sexy ideas if you are working hard on the right asset class (i.e., 100% ownership stake of a private company with exit options).

Do not choose the wrong wealth creation vehicle for the level of your talent and ambition.

Consumer / DTC (direct to consumer) businesses are more predictable asset class vs other venture bets

Good thread on why consumer / DTC businesses is investible as long as the return expectation is not venture level.

Thread above has interesting method to determine whether there’s still opportunity to compete in a certain space. Bonus: Thrasio (the Amazon brand aggregator) apparently does zero value add in Gen Z marketing for their portfolio brands.

Small medium businesses (SMB) has scale ceiling - managerial capacity

Maybe it’s possible to start high operating leverage business as an “indie maker”

Building a tax-efficient conglomerates in the US

Thread on tax optimization in US-context, covering QSBS, C Corp Dividend deduction, C Corp redemptions, ESOPs, C Corp consolidation. First time founders have zero clue about this (their focus is value creation). Second time founders pay significant attention to this (their focus is value protection - they already assume they can create value). What is QSBS & how it saves founders MILLIONS (video below at 34:30 minute mark on why Founders need to be proficient in taxes).

You still need to drive this though. Very important to have your own vision to drive advisors like accountants/lawyers/etc. (even for something as boring as optimized corporate structure for tax efficiency)

Why nations should make friends (and trade partners)

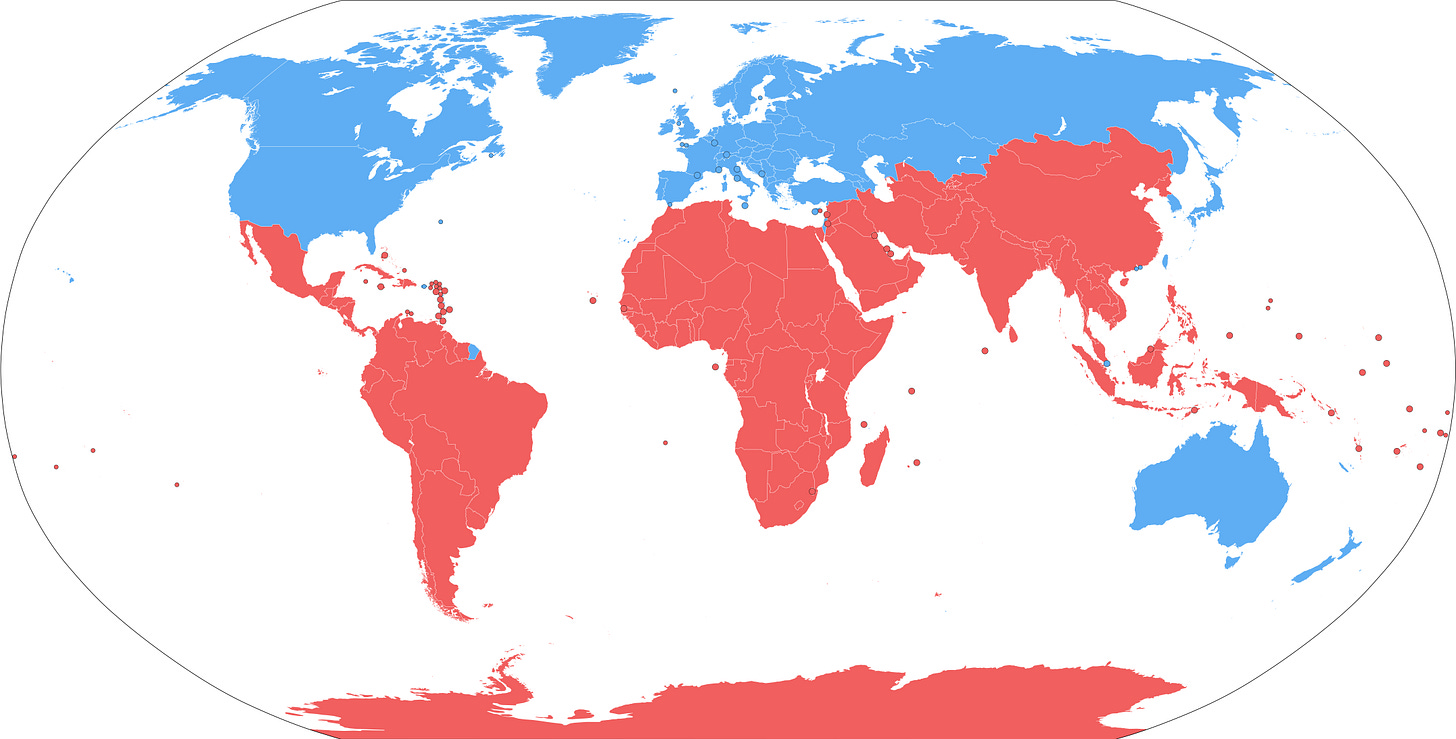

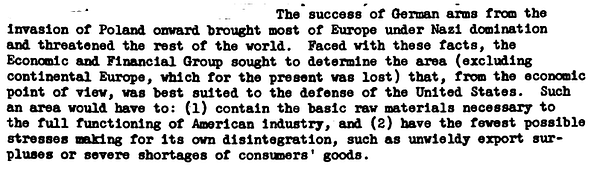

Great powers have tendencies to carve out their spheres of influences. Examine China’s reaction to US sanctioning of Russia - China needs to forge their own international system that rely less on US and its allies.

Takeaways: Sanctions, export controls, friend-shoring and alliance-building are damaging the world economy and further alienating China from the current US-led international order. China must respond to this growing trend by building a “new type of international system” with other countries in the Global South.

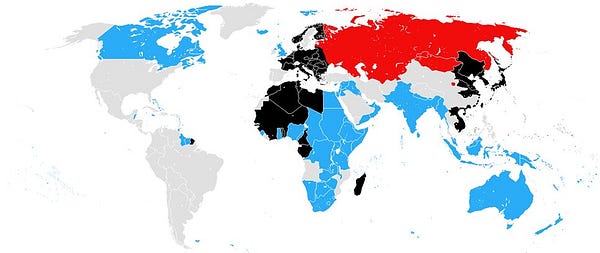

Interestingly, US decisions to wage wars (eg., the World Wars) are sensitive to trade access as discussed below:

What about Indonesia? Who are Indonesia’s friends who are not NATO-aligned / PRC-aligned? Southeast Asian countries / ASEAN? We are in the same neighborhood, but have nowhere the same level of integration like those in European Union. Islamic countries? Mostly are autocrats / weak democracies with weak institutions. Africa? We had brief history during non-aligned movement, and are somewhat fellow emerging economies. Proactively architecting your own alliance network / international system in the next few decades / few centuries is very interesting and feels very much like below, you are designing machinations that will run by itself long after you die:

Curiosities of the week

Hot takes

“We have empirical evidence that Baker Scholars (Top 5% of academic achiever in Harvard Business School) tend to do less well in the long run” - one Harvard professor said in 2023. This is a bold claim, an insane statement if true. Wondering on (a) what does it mean by “less well” (lifetime income? net worth? non-financial achievements?), and (b) what factors drive that (risk-aversion? willingness to defer to “excellence” defined by the school vs defining your own “excellence”? other factors?).

Open questions

US bankruptcy code is regarded as change to start fresh, recovering from failure (Chapter 11). What about Indonesia bankruptcy code? What behavior does it punish/reward? Hotman Paris, famous lawyer in Indonesia, did say that “bankruptcy code in Indonesia is unnecessarily cruel”. I wonder what he meant by this and what does it imply for risk-taking in general. Can we superimpose severity / leniency of bankruptcy codes across different countries and look whether it has meaningful impact on the rate of business formation? Does Indonesia’s bankruptcy code needs to change? What does it take to change (e.g., legal procedures, etc.)?

Books / papers

Returns to Talent and the Finance Wage Premium - finance jobs pays 3x the compensation for the same level of talent vs other industries because they can “move size” better vs other industries. Interestingly, the research was carried out in French school of Grand Ecoles because the admission only use tests. I guess if the research is done in US, the result will be distorted because of essays and recommendation letters.

Graphs / charts / tables / maps

Gen Z hang out longer on YouTube vs other social medias

Given the usage profile, seems that YouTube videos are digital real-estate assets with predictable cash flows. I know that Indonesia recently passed a regulation allowing the use of YouTube videos as collateral for loans. Wondering whether lenders have appetite for this new asset class.